Life happens. While I made a note of my gratitude items each day, I did not get a chance to post them. So here’s the past week:

Day 30:

Today, I saw AMERICAN SNIPER (which was excellent, by the way). I am always amazed by those who have the courage and passion to serve this country, as I don’t think I could stand on the battle lines. So today I am thankful for those who serve our country to protect our freedom.

Day 31:

Bella just turned 2 a couple of weeks ago. While the time is going by so very quickly, I am also thankful for this age. She can finally communicate with words her needs and wants, she understands commands from me, and best of all, we can go “play”! She is at such a fun age where she is curious about everything and has such a great awareness of the world around her. I can now take her to playgrounds and kids’ museums and the zoo – so many fun places!

Day 32:

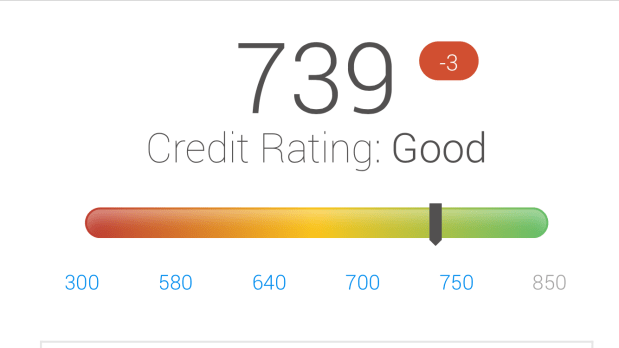

This weekend, Blaine and I stumbled upon an amazing deal on a foreclosed house for ourselves. In talking about the possibility of pursuing it, I decided to bring up my credit score. For those who haven’t followed my story, I filed bankruptcy during the peak of the recession (following job loss and all that comes with that). Four years later, I am in a much better place, and have managed to pay off all remaining debt (the car and my hefty student loans were excluded from the bankruptcy). Today, I am thankful for second chances and the ability to rebuild after tragedy, as my credit score is the highest it has ever been!

Day 33:

My work team has seen A LOT of changes over the past year. Namely, we have gone through an entire culture change, nearly a complete turnover of our HPLT (high performance leadership team), and turnover of a third or so of our team members. It was a tough road, but we are in SUCH a better place now as a result, and 2015 is already off to an amazing start! Today, I am thankful for the new faces at our HPLT table, as I think we have a strong, cohesive team to propel us to the next level!

Day 34:

Blaine and I put in an offer for the house we found over the weekend, and I became so excited and fixated on it that I was already imagining where we would put things. I could just *see* and *FEEL* us in this house. Alas, it was not in God’s plan, as someone swooped in with a cash offer well above our financed offer. I was heartbroken. And yet, it was a reminder that I need to learn to trust in God’s plan for us. This house or this time just wasn’t right, and there is other business we need to take care of before we settle into our dream home. Today, as hard as it is to swallow, I am thankful for that reminder.

Day 35:

I was pretty disappointed about not getting that house. Blaine was trying to be encouraging that we would one day have our house, but maybe the timing wasn’t right and we need to get some other business aligned first. This loss gave us an opportunity to discuss many things – our present, our future, and most of all, how fortunate we are to have all that we currently have. I love theses moments when we can really connect with emotional intimacy and have a great chat about life. We don’t get those moments often – mostly because life is so busy and we don’t take (or make) the time to pause and have these discussions. So today, I am thankful for this rare gem that has the power to refuel our marriage and remind us why we have chosen each other.